Find Airtel Payment Bank IFSC Code

Introduction

This makes financial transactions both correct and secure in today’s digital economy. More payments are being made online, so knowing the necessary tools of banking, such as an IFSC code, will be crucial. Thus, understanding how IFSC codes work can further ensure smooth transactions as well as instill confidence while operating their finances online for users of Airtel Payment Bank.

Why Knowing the IFSC Code Is Essential

Imagine sending money to your friend or some online service without knowing the unique identifier of that bank branch of your friend. IFSC code ensures that your funds reach the right destination. Whether it is in an NEFT, RTGS, or a UPI payment, knowing the proper IFSC code cuts off errors in the transaction while ensuring its successful completion. This small little piece of information may make all the difference for Airtel Payment Bank users between being lost in the digital banking wilderness and finding their way around.

Role of Airtel Payment Bank in E-wallet Transactions

Airtel Payment Bank has totally changed the conventional view about banks. Being a digital-first bank, the institution caters to services that are tailored toward a technology-savvy customer. It is with the use of the power of IFSC codes that Airtel Payment Bank provides fast, secure, and seamless transactions and hence forms an integral part of the digital banking scenario of India.

What constitutes an IFSC code?

Analysis of Terminology: Indian Financial System Code

The Reserve Bank of India (RBI) has assigned an alphanumeric identifier to each bank branch, more commonly known as the Indian Financial System Code or IFSC. It is normally 11 characters in length and contains all information related to the bank and its branch, thus being one of the most crucial details for identifying the recipient of electronic fund transfers.

How IFSC Codes Work in Banking Transactions

An IFSC code is like the postal address of a bank. The IFSC code ensures that the funds are being transferred to the right institution and branch when an electronic payment is initiated. Whether it is NEFT, RTGS, or IMPS, the code removes all ambiguity and makes the process automatic.

IFSC codes are important for online payments

In the age of speed and reliability, the IFSC codes ensure the payment reaches the recipient without a hitch. Absolutely indispensable in the processing of online transactions by reducing errors and preventing financial fraud as they offer verification checkpoints in the flow of payments.

Understanding Airtel Payment Bank

Airtel Payment Bank Overview in Brief

Airtel Payment Bank is an innovative venture launched in the banking sector of India that brings together telecommunication with banking services. It will bring banking to the fingertips of millions of its customers from deprived regions.

The Airtel Payment Bank services are:

Apart from the services targeting easier money management, Airtel Payment Bank has savings accounts and digital wallets. There are money transfer, bill payments for utility services, and recharges on the mobile number within its mobile application and other interfaces.

How Airtel Payment Bank Supports Seamless Digital Banking

Airtel Payment Bank emphasizes convenience. The bank employs advanced technology in ensuring that its banking activities are secure, fast, and user-friendly. Tying up with UPI and the use of IFSC codes have made transactions within the country and abroad pretty simple.

Why You Would Need to Use the IFSC Code Airtel Payment Bank

Linking the bank accounts through UPI and NEFT

It allows the smooth completion of UPI and NEFT transfers as the linking of one Airtel Payment Bank account too requires an IFSC code in order to track your branch, and for its proper routing.

Simplifying online money transfers

Whether it is an item purchase or sending money to a relative, the right Airtel Payment Bank IFSC code of use ensures that the funds will be processed quickly and surely.

Ensuring smooth processing of government benefits

From subsidies to pensions, government benefits normally need IFSC verification so that such funds reach the right accounts. IFSC code is what Airtel Payment Bank offers to ensure processes remain seamless.

Quick Ways to Find Airtel Payment Bank IFSC Code

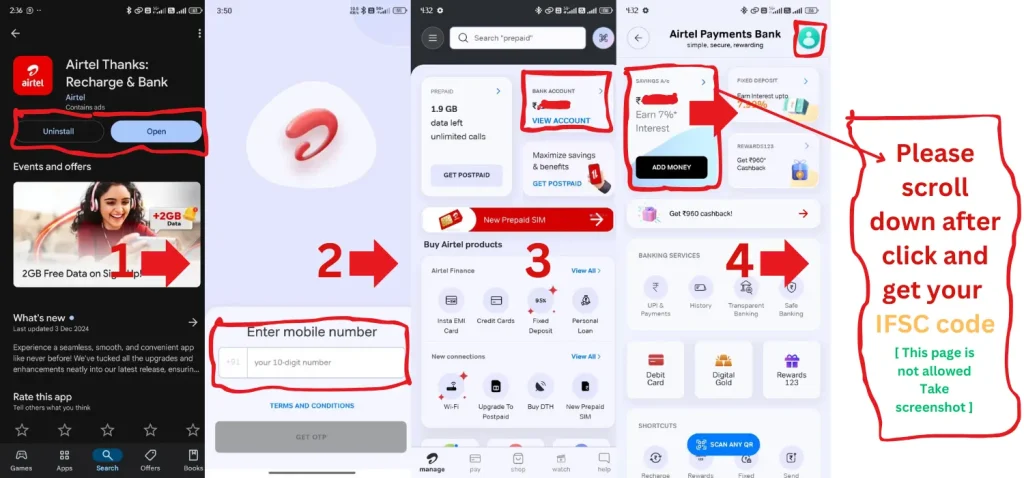

Exploring the Airtel Thanks App

You can access the Airtel Thanks app, which is the all-in-one solution by you as the user of the Airtel Payment Bank. You can refer your branch’s IFSC on entering the banking section.

Airtel Thanks App Link: https://play.google.com/store/apps/details?id=com.myairtelapp&hl=en_IN

Accessing the official Airtel Payment Bank website

The Airtel Payment Bank website has a separate section for fetching IFSC codes. It has easy search functionality, so it is easy to find your branch’s code.

Airtel Payment Bank website Link: https://www.airtel.in/bank/

Using Internet Banking Platforms

Most internet banking platforms have this IFSC code very prominently displayed within Airtel Payment Bank’s interface, so you’ll always have access to current information.

Airtel Payment Bank website Link: https://www.airtel.in/bank/

The Reserve Bank of India plays a significant role in IFSC codes.

How the RBI Issues IFSC Codes to Banks

Reserve Bank of India issues IFSC codes. Each code that Reserve Bank of India issues to any of its branches is unique, which further helps in uniformity and accuracy of the system in banking.

Where to Access the RBI’s Database for IFSC Codes

The RBI website keeps an exhaustive list of IFSC codes. It is an official source that cross-verifies codes of all banks, including Airtel Payment Bank.

RBI website Link: https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx

How to Find Airtel Payment Bank IFSC Code Online

Use of the Airtel Thanks App: Step-by-Step Guide

- Open the Airtel Thanks app, then log in.

- Go to the banking section.

- Locate your account details clearly with the IFSC code.

Surf through third-party financial websites.

There are many reliable financial portals where one can find an IFSC code by putting the name of the bank and the branch. These websites generally offer up-to-date information.

Leaning on government websites for accuracy

The best source of verified IFSC codes can be accessed from government portals, especially the RBI website.

RBI website Link: https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx

Offline methods to get Airtel Payment Bank IFSC code

Check your Airtel Payment Bank Account passbook.

The account passbook is the most reliable source for the IFSC code. It normally appears printed along with the account details.

Reaching Airtel Payment Bank Customer Support

One may ring or send an email to Airtel Payment Bank customer care to receive the Airtel Payment Bank IFSC code.

Airtel Payments Bank customer care number: 1800-23400

Visit Airtel Payment Bank Outlets

If someone prefers to interact face-to-face, then visiting an Airtel Payment Bank outlet would ensure that you get precise help.

Mostly Challenges when Searching Airtel Payment Bank IFSC code

What to Do If the Code Is Missing from Documents

In case the IFSC code cannot be found, customers may contact the Airtel Thanks app or dial up to the customer service hotline.

Avoid reliance on non-authenticated sources of information.

Login RBI databases and the original Airtel sites for primary source references to update.

Confirm Airtel Payment Bank IFSC Code

Double-checking the codes through official channels.

Always cross-check the Airtel Payment Bank IFSC Code through Airtel Payment Bank’s application or website to avoid any type of mistake.

Use secure apps and websites for verification.

Use safe sites to authenticate the codes and thus prevent scamming or misleading.

Tips on Safe Storage of IFSC Codes

Create a digital log for easy access.

Keep a secure digital record of frequently used IFSC codes to save time on transactions.

Avoid sharing codes unnecessarily.

Limit the sharing of sensitive banking details including IFSC codes to protect your account.

Mistakes to watch for while searching for IFSC Codes

Falling into Spam and Scams

One must always use authentic apps or the RBI portal so as not to visit fraudulent websites.

Using generic codes that don’t validate

Generic or outdated codes may result in failed transactions. Check before using.

How IFSC Codes Improve Transaction Security

Importants of Identifiers in Online Transfers

An IFSC code is the identifier number which ensures safe transaction of funds to the receiving account.

How secure systems like Airtel Payment Bank work

Airtel Payment Bank utilizes the robust systems that utilize IFSC codes to ensure high security in transactions and reduce frauds.

Frequently Asked Questions

Can I access Airtel Payment Bank service using an IFSC?

All UPIs require an ifsc code, although not necessarily for basic transactions; NEFT and RTGS fall under this category as well.

What happens if I get the wrong IFSC code?

This means that an incorrect Airtel Payment Bank IFSC code can result in a failed or misdirected transaction. Check twice, always.

Do Airtel Payment Bank IFSC codes vary in rural areas?

Airtel Payment Bank IFSC codes are location-specific, not location-based. The rural branches, therefore, will have unique IFSC codes just like urban counterparts.

Airtel Payment Bank IFSC code and its impact on UPI

Role of IFSC Codes in Seamless UPI Transaction

Airtel Payment Bank has incorporated IFSC codes to ensure fast and reliable UPI transactions.

Why Airtel Payment Bank is the game changer in digital payments.

It has been a digital payment solution leader because it has followed a user-centric approach along with robust infrastructure.

Airtel payment bank Vs. Traditional bank for use of IFSC

Easy access to IFSC Codes in Airtel Payment Bank

With its digital-first model, Airtel facilitates the access of users to any IFSC code anytime anywhere.

Comparing Airtel Payment Bank with Other Banking Services

Unlike traditional banks, Airtel Payment Bank prioritizes user convenience, making IFSC code retrieval straightforward and efficient.

Future of IFSC Codes in Digital Banking

Will IFSC codes become the past?

While alternatives like QR codes are emerging, IFSC codes remain foundational for structured banking transactions.

How banking innovations are developing payment systems

From blockchain to AI-driven banking, it is changing the way to think about payments, but there is still a lot attached to IFSC codes.

Conclusion

In regard to digital banking, that IFSC code would mean being the most valuable resource that a person dealing with Airtel Payment Bank uses because they get to understand and know the importance of how to retrieve and confirm such codes.

Call to Action

Airtel Payment Bank offers experience digital banking to customers. Download the Airtel Thanks App app now and explore a world of easy-to-conduct financial transactions.